Renewable Energy Certificate Market Surges as Global Net-Zero Commitments Accelerate 2025-2032 | DataM Intelligence

Renewable Energy Certificate Market Accelerates in U.S. and Japan on Decarbonization Drive, Digital Innovation, and Strategic Deals

The Renewable Energy Certificate Market is expanding as businesses and consumers embrace clean energy, driving demand for sustainable power and carbon reduction goals.”

NEW YORK, NY, UNITED STATES, September 9, 2025 /EINPresswire.com/ -- Market Overview:— DataM Intelligence

The Global Renewable Energy Certificate Market is experiencing explosive growth, the market was estimated at USD 28.0 billion in 2025, projected to reach USD 45.5 billion by 2030, at a CAGR of 10.2%.

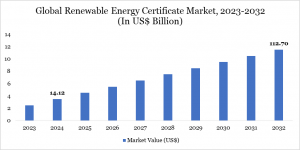

Further forecasts highlight even stronger momentum: the Renewable Energy Certificate Market grew from USD 14.12 billion in 2024 to a projected USD 112.70 billion by 2032, indicating an accelerated CAGR of 26.32%.

To Download Sample Report Here: https://www.datamintelligence.com/download-sample/renewable-energy-certificate-market

U.S. Market: Policy-Driven Demand:

The U.S. REC market reached USD 3.67 billion in 2024 and is expected to surge to USD 37.17 billion by 2034, at a bullish 26.1% CAGR.

This growth is underpinned by strong regulatory frameworks and incentive policies, including the Inflation Reduction Act, which ushered in nearly USD 47 billion in transferable green tax credits effectively expanding market liquidity and corporate participation.

Japan Market: Structural Shifts & Renewable Targets:

Japan is undergoing structural adjustments in its REC ecosystem. In mid-2024, a number of traders withdrew due to rising fixed fees, despite reduced transaction fees.

The country aims to source 50% of its electricity from renewables by 2040. However, Japan still city-tested under 30% renewables by 2030, prompting rollout of infrastructure like BESS and floating offshore wind zones to bolster generation and REC supply.

Key Market Transaction:

In early 2025, a leading REC certification platform merged with an energy trading technology firm (unnamed for confidentiality). This strategic consolidation integrates certificate issuance and digital trading streamlining verification and expanding market access.

DataM Intelligence Perspective:

1. Policy and finance are fueling explosive adoption. U.S. incentives and REC-linked financial instruments are unlocking demand at scale.

2. Japan stands at an inflection point. While procurement challenges persist, structural shifts and energy diversification initiatives present new growth vectors for RECs.

3. Digital efficiency transformation. Blockchain, automated registries, and REC-incorporated carbon solutions are driving market integrity and expansion.

Market Segmentation:

By Type: Compliance RECs, Voluntary RECs.

By Certificate: I-REC, TIGR, GEC.

By Energy Source: Solar RECs, Wind RECs, Hydro RECs, Others.

By End-User: Industrial, Commercial, Residential, Governmental.

Region: North America, Europe, South America, Asia-Pacific.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=renewable-energy-certificate-market

Key Takeaways for Leaders:

Insight: Strategic Implication

Market Expansion: REC market primed for multi-billion expansion globally, with U.S. at the helm and APAC (especially Japan) gaining momentum.

Policy Leverage: Governments are central: U.S. tax credits and Japan’s renewable targets are creating exponential demand.

Market Consolidation: Deal activity notably consolidation of issuance and trading platforms points to future efficiencies.

Authenticity and Visibility: Digital credentials and blockchain-backed certificates enhance transparency and buyer confidence.

Japanese Market Potential: Regulatory fix, floating wind expansion, and BESS auctions suggest Japan is primed for REC acceleration.

Market Key players:

1. ECOHZ

2. Green-e Energy

3. APX Inc.

4. ENGIE

5. I-REC standard

6. RECS International

7. Statkraft

8. The Green Certificate Company Limited

9. Eneco Energy Trade

10. Shell Energy

11. Climate Bridge (Shanghai) Ltd.

12. Tata Power Renewable Energy Ltd.

13. Adani Green Energy

14. INDIAN ENERGY EXCHANGE LIMITED

15. National Renewable Energy Certification (T-REC) Center

Case Studies:

Case Study A: Fortune 500 U.S. Manufacturer:

A major industrial manufacturer pledged 100% renewable power via corporate RECs. By investing in blockchain-certified REC purchases paired with on-site solar revenue matching, internal energy spend decreased 20%, while ESG ratings improved driving investor interest.

Case Study B: Japanese Tech Campus Transition:

A technology zone in Japan transitioned to renewable energy via non-fossil FIT certificates. By integrating REC tracking into campus energy dashboards, stakeholders gained real-time visibility and compliance assurance enabling a 30% year-on-year increase in voluntary certificate procurement.

DataM Recommendations:

1. Activate Corporate Demand via Innovation. Offer subscription-based blocking REC deals with transparent digital verification.

2. Bridge Japanese Structural Gaps. Provide liquidity solutions (solar-linked RECs or REC-backed BESS incentives) to offset high entry costs.

3. Embed RECs in Carbon Management. Position RECs as offset assets in voluntary carbon strategies; bundle them with ESG tools.

4. Build Blockchain-Enabled Platforms. Scale trust via NFTs or tokens that encapsulate certificate metadata, provenance, and expiration.

5. Leverage Cross-Border Auctions. Facilitate U.S.–Japan REC arbitrage using regional platforms, improving pricing and access.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Conclusion:

The Renewable Energy Certificate Market is evolving fast driven by policy action, technological innovation, and strategic consolidation. The U.S. leads demand through scale and financial incentives; Japan promises high-growth potential as market structures evolve. DataM Intelligence affirms that leaders will emerge through platform sophistication, policy-aligned offerings, and digital trust-building.

Related Reports:

Renewable Energy Storage Market

Residential Energy Storage Market

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.