Contract Logistics Market Size USD 545.02 Billion by 2032 – AI , 3PL & Last-Mile Trends

With AI and cloud-based solutions, the contract logistics market is evolving rapidly, allowing companies to optimize transportation management.

Technological innovation and logistics outsourcing are transforming the contract logistics market, enabling faster, smarter, and more efficient supply chains globally.”

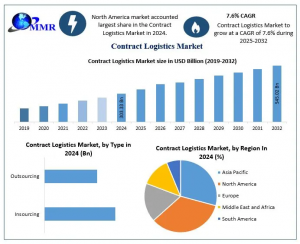

WILMINGTON, DE, UNITED STATES, October 8, 2025 /EINPresswire.com/ -- The Global Contract Logistics Market, valued at USD 303.33 Billion in 2024, is projected to reach USD 545.02 Billion by 2032, growing at a CAGR of 7.6%. Rapid adoption of AI, warehouse robotics, last-mile delivery solutions, advanced warehouse management systems (WMS), and 3PL services is transforming supply chain management and driving market expansion worldwide.— Dharti Raut

Contract Logistics market is undergoing rapid transformation, driven by technological innovations, e-commerce growth, and strategic acquisitions. In 2024, Asia Pacific accounted for 34% of the market share, while emerging markets in South America and the Middle East are witnessing rising demand for 3PL services, last-mile delivery, transportation management, and inventory optimization. AI and warehouse robotics are revolutionizing operations, with companies like IKEA investing USD 2.2 billion in AI-driven logistics technologies to optimize delivery and reduce costs by over USD 117 million annually. Cloud-based SaaS solutions and blockchain are enhancing transparency, enabling real-time tracking, efficient inventory management, and predictive supply chain decisions.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/165033/

The market is segmented into warehousing (42% revenue), transportation (28%), freight forwarding solutions, and value-added services (18%), with providers integrating advanced warehouse management systems (WMS) and AI for optimized operations. Leading regional players include C.H. Robinson, XPO Logistics, Nippon Express, CJ Logistics, and Geodis, collectively managing significant 3PL contracts. Strategic mergers, infrastructure investments, and digital adoption are driving a more resilient, scalable, and customer-centric logistics ecosystem worldwide.

AI and Robotics Revolutionizing Contract Logistics Operations

The Contract Logistics market is witnessing a technological revolution, driven by artificial intelligence (AI), machine learning, and warehouse robotics. AI is being leveraged to optimize transportation routes, improve demand forecasting, and enhance budget planning, potentially delivering 89% incremental value compared to other technologies. Warehouse robotics, supported by major investments such as Alibaba’s $15 billion and Google’s $500 million contributions to automated logistics infrastructure, are accelerating operational efficiency and reducing human intervention. Cloud-integrated logistics software now enables real-time tracking, inventory management, and 360-degree process visibility, providing substantial cost savings on delayed deliveries and misrouted consignments. This fusion of AI, robotics, and cloud technology allows contract logistics providers to offer predictive and responsive services, meeting the demands of modern supply chains.

Cloud-Based SaaS and Blockchain Enhancing Supply Chain Transparency

Cloud-based Software-as-a-Service (SaaS) solutions and blockchain technology are reshaping contract logistics by increasing flexibility, transparency, and operational resilience. Cloud systems offer a collaborative overview of logistics processes while reducing initial and ongoing costs, enabling providers to scale services efficiently. Blockchain-enabled secure databases enhance trust and eliminate intermediaries by digitizing contracts, streamlining administrative processes, and enabling effective audits across the supply chain. Moreover, the adoption of logistics software across sectors has streamlined operations, improved delivery accuracy, and eliminated operational bottlenecks. Together, these innovations empower logistics providers to deliver value-added services, including real-time monitoring, demand-driven inventory management, and rapid decision-making, driving the growth and evolution of the global contract logistics market.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/165033/

Diverse Service Segments Fuel Contract Logistics Market Expansion

The Contract Logistics market is segmented into warehousing, transportation, freight forwarding, and value-added services, each playing a crucial role in enhancing supply chain efficiency. Warehousing remains the largest contributor, accounting for approximately 42% of the total service revenue in 2024, driven by the rising demand for automated storage solutions and temperature-controlled facilities for pharmaceuticals and perishable goods. Transportation services, including last-mile delivery, account for 28% of revenue, fueled by rapid e-commerce growth and the need for timely order fulfillment. Freight forwarding services are witnessing steady adoption, particularly in cross-border operations, where secure documentation, route optimization, and customs compliance are critical. Value-added services such as packaging, labeling, assembly, and reverse logistics are gaining traction, representing 18% of the market share, as companies increasingly seek integrated solutions to reduce costs and improve service quality.

Technological integration within these segments is a key growth driver, with warehouse management systems (WMS), AI-driven route planning, and cloud-based logistics platforms enhancing operational efficiency. Contract logistics providers that offer a combination of these services can cater to diverse industries, including e-commerce, automotive, retail, and pharmaceuticals, positioning themselves as indispensable partners in modern supply chain ecosystems.

Asia Pacific Leads Global Contract Logistics Growth Amid Rising E-Commerce

The Contract Logistics market exhibits significant regional variations, with Asia Pacific emerging as the dominant growth hub. In 2024, the region accounted for approximately 34% of the global market share, driven by rapid e-commerce adoption, a robust manufacturing base, and expanding industrial infrastructure. China, India, and Southeast Asian countries are witnessing strong demand for third-party logistics (3PL) services, warehousing solutions, and last-mile delivery optimization. North America follows closely, fueled by the presence of major logistics providers, advanced warehouse automation technologies, and the growing emphasis on supply chain resilience. Europe also holds a substantial share, with countries like Germany, the United Kingdom, and France investing heavily in cold chain logistics, cross-border freight forwarding, and value-added services to meet the increasing demands of the retail, automotive, and pharmaceutical sectors.

Emerging markets in South America and the Middle East are presenting new opportunities, as logistics outsourcing, transportation management solutions, and inventory optimization become priorities for regional businesses. Cloud-based logistics platforms, AI-driven route planning, and blockchain-enabled supply chain tracking are being rapidly adopted across regions, enabling providers to deliver integrated, scalable, and efficient services. These regional dynamics indicate that contract logistics providers leveraging technology and local expertise will be best positioned to capitalize on global growth opportunities.

Strategic Acquisitions Enhance Logistics Capabilities

October 7, 2025: IKEA acquired U.S.-based logistics technology firm Locus to enhance its delivery capabilities and support online sales growth. The acquisition is part of a $2.2 billion investment aimed at strengthening IKEA's position in the competitive U.S. market. Locus uses AI to optimize delivery routes and order grouping, streamlining processes currently done manually. This acquisition is expected to save IKEA approximately €100 million ($117.4 million) annually in global delivery costs

April 27, 2025: French shipping giant CMA CGM, through its subsidiary CEVA Corporate Services, signed an agreement to acquire Turkish conglomerate Borusan's logistics division for $440 million. The acquisition will significantly expand CEVA’s logistics operations in Turkey by nearly doubling its warehousing and distribution capacity, adding 570,000 square meters to its current 620,000 square meters

Emerging Market Trends Driving Supply Chain Efficiency

E-Commerce Growth: Online retail demand has led to a 28% surge in last-mile delivery services in major urban centers worldwide.

Cold Chain Logistics Expansion: Temperature-controlled storage and transport solutions are increasing by 22% annually to meet pharmaceutical and food sector requirements.

Sustainability Focus: 40% of logistics providers are investing in electric vehicles and eco-friendly packaging solutions to reduce carbon emissions.

Major Players Driving Innovation in the Contract Logistics Market

The Contract Logistics market is highly competitive, with leading players focusing on technological integration, service diversification, and strategic partnerships to strengthen their global footprint. Key companies, including DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, and CEVA Logistics, collectively handle over 45% of global 3PL contracts, reflecting their dominant presence in warehousing and transportation services. Investments in warehouse automation, AI-driven route optimization, and cloud-based supply chain management solutions are projected to improve operational efficiency by up to 30%, according to industry reports. Strategic mergers and acquisitions are shaping the competitive landscape, with over 120 acquisitions recorded globally in the past three years to expand regional capabilities and service portfolios.

Innovation remains a critical differentiator, as logistics providers integrate robotics, blockchain technology, and predictive analytics to deliver seamless, real-time operations. Companies leveraging advanced warehouse management systems (WMS), transportation management software, and automated inventory solutions are better positioned to meet growing e-commerce and retail demands. With increasing global supply chain complexity, competitive players focusing on technology-driven, scalable, and flexible logistics solutions are expected to capture significant market share, solidifying their leadership in the evolving contract logistics ecosystem.

Contract Logistics Market Key Players

North America

C.H. Robinson – United States

XPO Logistics – United States

Ryder Supply Chain Solutions – United States

Lineage Logistics – United States

Total Quality Logistics (TQL) – United States

JB Hunt Transport Services – United States

Schneider Logistics – United States

Kenco Logistics – United States

Hub Group – United States

Echo Global Logistics – United States

Europe

Geodis – France

Groupe Charles André – France

ID Logistics – France

Kuehne + Nagel – Switzerland

DB Schenker – Germany

DHL Supply Chain – Germany

DSV Panalpina – Denmark

Rhenus Logistics – Germany

Norbert Dentressangle – France

XPO Logistics – France

Asia-Pacific

Nippon Express – Japan

Kintetsu World Express – Japan

Yusen Logistics – Japan

Sinotrans – China

CJ Logistics – South Korea

Hyundai Glovis – South Korea

Sagawa Express – Japan

Mitsubishi Logistics – Japan

Nippon Yusen Kaisha (NYK Line) – Japan

Kerry Logistics – Hong Kong

Analyst Recommendation: Industry analysts recommend that contract logistics providers invest in AI-driven solutions, warehouse robotics, and cloud-based platforms to enhance operational efficiency and scalability. Companies should focus on integrated 3PL services, last-mile delivery, and value-added solutions to meet rising e-commerce and industrial demand. Strategic acquisitions and regional expansion are also advised to maintain a competitive edge.

Contract Logistics Market FAQs

What is the Contract Logistics market and its significance?

Ans. The Contract Logistics market involves outsourcing logistics operations to specialized providers, improving efficiency in supply chain management. Companies leverage logistics outsourcing to optimize warehousing, transportation, and inventory control, reducing operational costs and enhancing service quality.

Which services are included in third-party logistics (3PL) solutions?

Ans. Third-party logistics (3PL) providers offer comprehensive services, including transportation management, warehousing, freight forwarding, and value-added solutions such as packaging and reverse logistics. These services help businesses streamline supply chains, improve delivery accuracy, and respond to growing e-commerce and retail demands.

Which regions are driving growth in the Contract Logistics market?

Ans. Asia Pacific leads global growth, fueled by rapid e-commerce expansion and industrial development. North America and Europe also show steady demand for logistics outsourcing, efficient transportation management, and integrated 3PL services, positioning the region’s providers as key market players.

Related Reports:

Contract Logistics Market: https://www.maximizemarketresearch.com/market-report/contract-logistics-market/165033/

Logistics Market: https://www.maximizemarketresearch.com/market-report/global-logistics-market/94795/

Maximize Market Research is launching a subscription model for data and analysis in the Automotive and Transportation Market: https://www.mmrstatistics.com/markets/318/automotive-and-transportation

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.